Solution To Your Home Mortgage Concerns

Article written by-Basse FrandsenWhen people think of mortgages, they often imagine pushy lenders and high interest rates. When you know a lot about the process of getting a mortgage, you'll find that these negative thoughts leave your mind completely. To learn all you can, read the content below which has been written by experts to provide you with the best advice available.

While you wait to close on your mortgage, avoid shopping sprees! Too much spending may send up a red flag to your lender when they run a second credit check a day or two before your scheduled meeting. Hold off on making a big furniture purchase or buying other big ticket items until you have completed the deal.

Before applying for a mortgage loan, check your credit score and credit history. Any lender you visit will do this, and by checking on your credit before applying you can see the same information they will see. You can then take the time to clean up any credit problems that might keep you from getting a loan.

Reducing your debt as much as possible will increase your chances of being approved for a mortgage. If you are not in a good financial situation, meet with a debt consolidation professional to get out of debt as quickly as possible. You do not need to have a zero balance on your credit cards to get a mortgage but being deeply in debt is definitely a red flag.

If you are underwater on your home and have been unable to refinance, keep trying. Recently, HARP has been changed to allow more homeowners to refinance. Lenders are more open to refinancing now so try again. If the lender will not work with you, look for someone who will.

Before you talk to a potential lender, make sure you have all your paperwork in order. The lender is going to need income proof, banking statements, and other documentation of assets. When you have these documents organized and ready to present to the lender, you will avoid wasting precious time when applying for your mortgage.

Look into no closing cost options. If closing costs are concerning you, there are many offers out there where those costs are taken care of by the lender. The lender then charges you slightly more in your interest rate to make up for the difference. This can help you if immediate cash is an issue.

Find out if the loan you are applying for is a fixed rate or adjustable rate loan. Generally adjustable rate loans offer lower interest rates; however, the interest rate can increase over time. With an adjustable rate loan, your interest rate can increase yearly; thus costing you more money in the long run.

Learn about fees and cost that are typically associated with a home mortgage. Go over your mortgage paperwork line by line make sure you understand each fee. It can feel very daunting. However, with the proper legwork, you can both talk the talk and walk the walk.

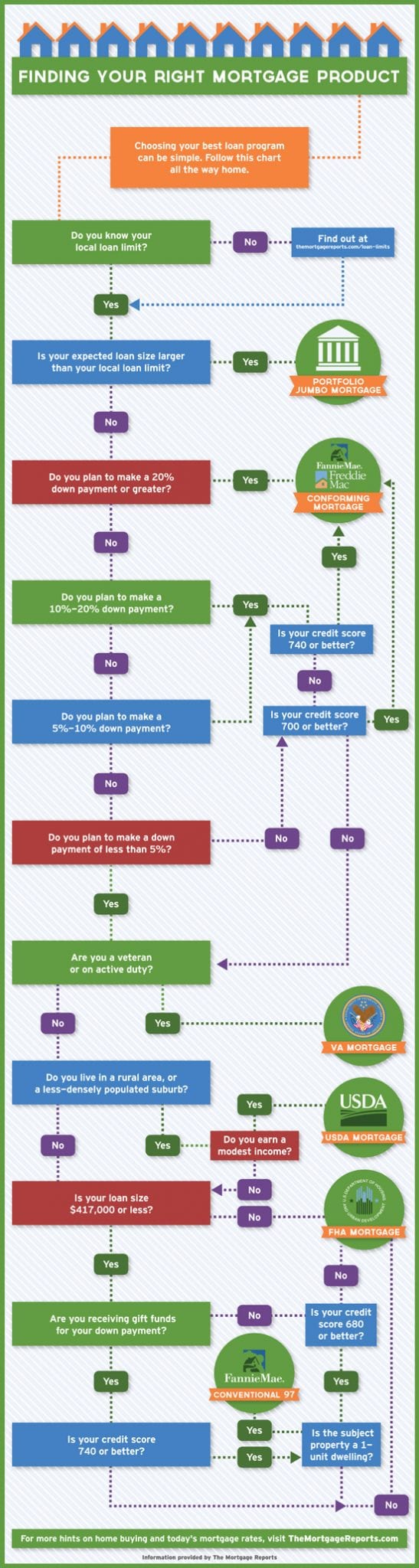

Determine which type of mortgage you need. There is more than one kind of home loan. When you know about the different kinds and compare them, that will make it easier to choose the kind of mortgage that is right for you. Talk to your lender about your mortgage options.

Learn about the three main types of home mortgage options. The three choices are a balloon mortgage, a fixed-rate mortgage, and an adjustable-rate mortgage (ARM). Each of these types of mortgages has different terms and you want to know this information before you make a decision about what is right for you.

Chose a bank to carry your mortgage. Not all companies who finance homes are banks. Some of them are investment companies and private corporations. Though you may be comfortable with them, banks are usually the easier option. Local bankers can usually cut down the turn-around time between application and available funds.

During your application for a home loan, get a rate-lock. A rate-lock in writing guarantees certain terms and interest rates for a given period of time. Set the rate-lock "on application" instead of "on approval". The lock-in period needs to be long enough to allow for factors that can delay the loan process.

Make sure that you compare mortgage rates from several companies before you settle on one. Even if the difference seems to be minimal, this can add up over the years. One point higher can mean thousands of extra you will have to shell out over the course of the loan.

Get your credit under control. If you currently have a wallet full of plastic for every occasion, you should downsize. Having too much available credit can harm your loan, even if it is not debt. Close any non-essential accounts. Chose a gas card, a store card, and a single credit card to keep.

Always tell the truth. Never ever lie when you are applying for a mortgage. Do not exaggerate your salary. Do not under-report your outstanding debts. This could land you even more debt that you cannot pay. It could seem like a good idea at first, but it might just come back to get you in the end.

Know the real estate agency or home builder you are dealing with. It is common for builders and agencies to have their own in-house financiers. Ask the about their lenders. Find out https://www.marketscreener.com/quote/stock/NORTHWEST-BANCSHARES-INC-5832675/news/Northwest-Bancshares-Bank-Names-Bryan-Jasin-Head-of-Business-Banking-39686720/ . This could open a new avenue of financing up for your new home mortgage.

Never hide from your debt. It does not feel good to not be able to pay your bills. Do not let that keep you silent. Your mortgage holder, and other creditors, will work with you if you tell them what is going on with your finances. Silence can result in judgements against you.

There are times when the seller of a home will be able to give you a land contract so you can purchase the home. The seller needs to own the home outright, or owe very little on it for this to work. A land contract may need to be paid within a few years.

While you may have thought that finding a good mortgage company and loan is difficult, that really isn't the reality. You just have to know what you're doing, and with the advice you've read, you're sure to do just fine. Make sure you look at every aspect of getting a mortgage, and you will end up with the right one.